Ministry of Finance and Federal Tax Authority Launch Initiative to Waive Late Registration Penalties under the Corporate Tax Law

UAE, April 29, 2025

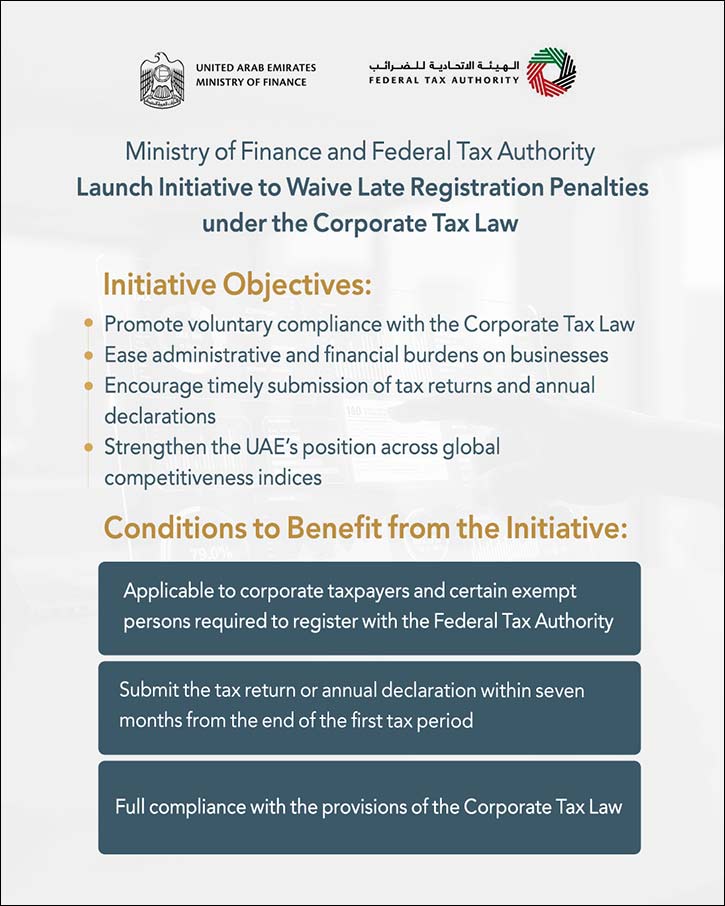

The Ministry of Finance (MoF) and the Federal Tax Authority (FTA) have announced the issuance of a Cabinet Decision launching an initiative to waive administrative penalties for corporate taxpayers and certain exempt persons who failed to submit their tax registration applications with the FTA within the required timeframe.

To qualify, eligible parties must file their tax return or annual statements within a period not exceeding seven (7) months from the end of their first tax period, as stipulated under the Corporate Tax Law.

The Cabinet’s decision reflects the proactive approach of the Ministry of Finance and the Federal Tax Authority to enhance tax compliance. It aims to encourage registrants to file tax returns or annual statements before the deadline, bolstering early compliance with legal requirements.

Additionally, the FTA confirmed that necessary procedures will be implemented to refund administrative fines collected from those who meet the specified criteria.

The initiative reaffirms the continued commitment of the Ministry of Finance and the Federal Tax Authority to enhancing the tax compliance environment in the UAE, facilitating procedures, and easing financial burdens on businesses. It aims to enable taxpayers to meet their obligations smoothly and benefit from the exemptions, provided they file their tax returns or annual declarations within the prescribed timeframe.

The decision is expected to significantly support the UAE’s ongoing effort to ensure better compliance during the first year of corporate tax implementation.

It underscores the government’s commitment to supporting national businesses by providing incentives that encourage voluntary compliance, reduce administrative and financial burdens associated with tax registration, and further strengthen the UAE’s standing across global competitiveness indices.

Home >> Local News and Government Section

ADIO and ITOCHU forge strategic partnership to accelerate investments into Abu D ...

Gargash Motors Launches AION and HYPTEC in the UAE as it Reimagines Tomorrow's E ...

Dubai Airports' Learning at Work Week building a future-ready workforce, one ses ...

The busiest year for baggage: Emirates' baggage handling success goes from stren ...

CABSAT 2025: France Powers the Future of Broadcasting and Media Innovation

Global Village extends Season 29 for additional seven days, now open until the n ...

RX to launch inter aviation Arabia in Riyadh in February 2026

RTA Completes All Phases of Al Shindagha Corridor Development Project on Bur Dub ...

Jay Vine impresses in first Giro d'Italia time trial

Bhima Jewellers UAE Launches “Bhima Super Woman Toastmasters Club” to Empower Wo ...

Dubai Customs becomes first global customs authority named a Great Place to Work ...

Mohammed Bin Rashid Library Welcomes Consul General of Peru to Discuss Cultural ...

Epic Finale: DEF 2025 Enters Its Final Weekend with Endless Fun and Mega Prizes ...

Emirates literature foundation unveils 2025's most inspiring school librarians

Dubai Electronic Security Center Concludes Its Participation at GISEC Global 202 ...

Hala Badri: showCACE 2025 is an Innovative Platform that Highlights the Power of ...

Mohammed Bin Rashid Library Welcomes Delegation From Ministry of Health and Prev ...

RAK Ruler supports RAKEZ and AHK strategic partnership

High-Level Russian Delegation Visits Mohammed Bin Rashid Library to Discuss Stra ...

Calling All Cosplay Fans! Bring Gaming Characters to Life at DEF's Dubai Cosplay ...